Adjustments to Gross Income Will Decrease Your Taxable Income.

5 Ideas for 2019. Contribute to a Health Savings Account A Health Savings Account HSA is a medical savings account designed for.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Your adjusted gross income AGI is simply your total gross income minus certain deductions determined by the IRS.

. Taxable income is calculated by deducting your allowable standard deductions from adjusted gross income AGI. Sue and Tim are married taxpayers in the 33 marginal tax bracket. Your adjusted gross income is your total income or gross minus any eligible deductions.

Reducing your adjusted gross income is extremely beneficial as its used to determine things like personal exemptions it lowers your taxable income and can even push you into lower tax brackets. Your adjusted gross income can be lowered by calculating above the line deductions. The 38 net investment income tax is based in part on a persons modified adjusted gross income over certain thresholds.

Only for amounts in excess of 10 of the adjusted gross income. Ask if the taxpayer andor spouse made any early withdrawals during the tax year. Increasing adjustments to income can also decrease other taxes because some surtaxes are calculated based on AGIs.

Your adjusted gross income definition is your total income reduced by the tax deductions that the tax code classifies as adjustments to income. Adjustments to gross income will decrease your taxable income. Your gross income consists of income from wages and salary plus other forms of income including pensions interest dividends and rental income.

How Do You Reduce Your Taxable Income AGI MAGI. Adjustments to gross income will decrease your taxable income. Taxpayers can adjust their gross income to deduct penalties they paid for withdrawing funds from a deferred interest account before maturity.

Adjusted gross income AGI is the total or gross income a taxpayer earns minus eligible deductions or adjustments to income which the IRS allows you to take against this income. Gross income includes your wages dividends capital gains business income retirement distributions as well as other income. Asked Aug 12 2019 in Business by Shawanna Answer the following statement true T or false F.

You can avoid paying this tax if you can reduce your AGI below those thresholds. Your taxable income will be less than your AGI due to the deductions. To find your AGI add all forms of income together then tax and subtract deductions from that amount.

Total medical expenses paid exceed 10 of your Adjusted Gross Income AGI. Any reduction in your gross income - AGI - MAGI - taxable income will lead to a reduction in your taxes. The 75 threshold was eliminated for 2017 and after.

For those under the age of 65 medical and dental expenses may be included as itemized deductions. Your AGI can be zero or even negative. Also you could choose to reduce the taxable retirement distributions you take in a particular.

Making Your Gifts Count. In fact giving any one person more than 13000 worth of gifts means you have to pay taxes on them. Its not too late to reduce your AGI for the current tax.

AGI Overview When preparing your tax return you probably pay more attention to your taxable income than your adjusted gross income AGI. Here are 5 ways to reduce your taxable income 1. Your adjusted gross income AGI equals your gross income minus adjustments to that income which are those amounts that are explicitly exempt from taxation according to the Internal Revenue Code IRC.

Adjustments to Income include such items as Educator expenses Student loan interest Alimony payments or contributions to a retirement account. For example lowering AGI can increase the amount of Social Security benefits that you can receive federal-income-tax-free and increase your allowable higher education tax credits. For many these restrictions will prevent any medical expenses paid out-of-pocket during the year from being deducted on their return.

The lower your AGI and the higher your medical and dental expenses the more you can deduct those. 50 credit or up to 1000 for individuals or 2000 for married couples filing jointly AGI below 19750 for individuals 29625 for heads of household or 39500 for married couples filing jointly. Use an AGI calculator to see eligible deductions and help you figure out your Adjusted Gross Income.

Enroll in an employee stock purchasing program If you work for a publicly traded company you may be eligible to. These adjustments ensure that you arrive at your actual income before the IRS subtracts the tax deductions and exemptions that provide your taxable income. If so ask to see Form 1099-INT Interest Income or Form 1099-OID Original Issue Discount.

Even though the IRS issued a newly designed Form. Buying or selling a house. Adjustments to the gross income will decrease your taxable income.

The money deposited into a traditional IRA reduces your adjusted gross income AGI for that tax year on a dollar-for-dollar basis assuming it is within the annual contribution limits see below. Some tax credits and deductions can benefit you more if your adjusted gross income is lower. True The gross income minus the tax exempt income equals the adjusted gross income.

Lowering your AGI reduces your taxable income for the year and your exposure to unfavorable AGI-based provisions. Tax ___ is an illegal practice. And if you are an investor you can make moves to create capital losses to offset up to 3000 of ordinary income.

The 75 threshold was eliminated for 2017 and after. Taxable income is a laymans term that refers to your adjusted gross income AGI less any itemized deductions youre entitled to claim or your standard deduction. The good news is that you can still find ways to help people and reduce your income tax in the process.

Here are the Adjusted Gross Income AGI limits for claiming the Savers Credit in for filing your taxes in 2021. One way to do that is by contributing to a 401k plan. The key is to give your gifts to charitable organizations that help others.

If you are self-employed you can reduce your income by deferring some of the payments you receive from clients or deducting more business expenses. Adjusted gross income AGI can directly impact the deductions and credits you are eligible for which can wind up reducing the amount of taxable income you report on your tax return. If for example your out-of-pocket medical and dental bills exceed 75 percent of your AGI in a year you can deduct the amount that exceeds 75 percent of your AGI.

How do I lower my adjusted gross income. In 2014 they sold common stock shares which they held for more than 40 months for a capital. Ultimately if your goal is to reduce your taxes you have to reduce your income.

Your AGI will never be more than your Gross Total Income on you return and in some cases may be. Other ways to lower your taxable income include.

Things That Will Lower Your Agi Tax Write Offs Business Tax Tax Deductions

/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)

Net Income Vs Adjusted Gross Income Agi What S The Difference

How To Calculate Adjusted Gross Income Agi For Tax Purposes

Standard Deduction Tax Exemption And Deduction Taxact Blog

Taxable Income Formula Calculator Examples With Excel Template

Will I Get Audited If I File An Amended Return H R Block Hr Block Audit Adjusted Gross Income

Learn How The Affordable Care Act Tax Law Changes May Impact Your Taxes Over The Next Three Years Https Www Taxact Adjusted Gross Income Cool Things To Make

What Are Marriage Penalties And Bonuses Tax Policy Center

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

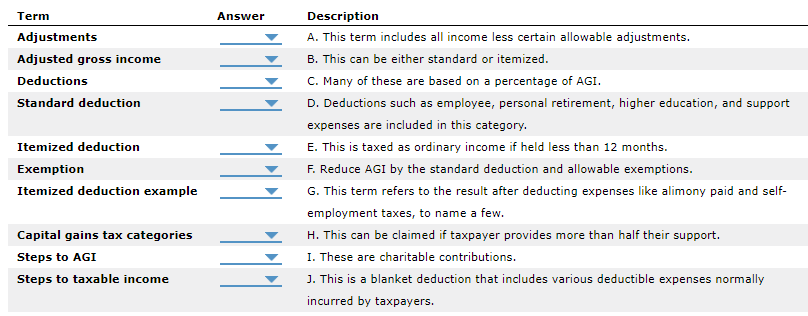

Solved Term Answer Adjustments Adjusted Gross Income Chegg Com

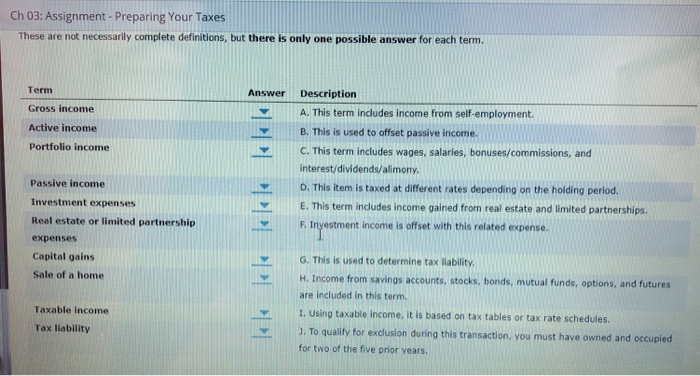

Solved Ch 03 Assignment Preparing Your Taxes These Are Chegg Com

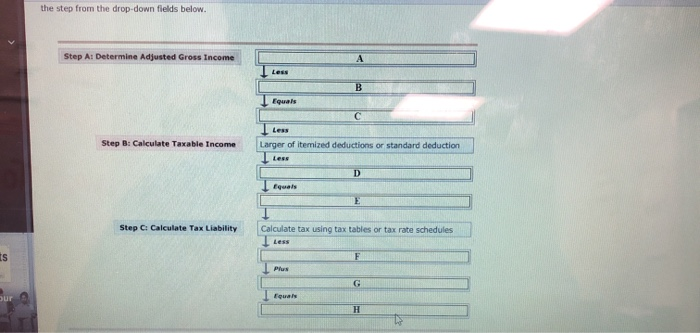

Solved Ch 03 Assignment Preparing Your Taxes These Are Chegg Com

Gross Vs Net Income How Do They Differ Smartasset

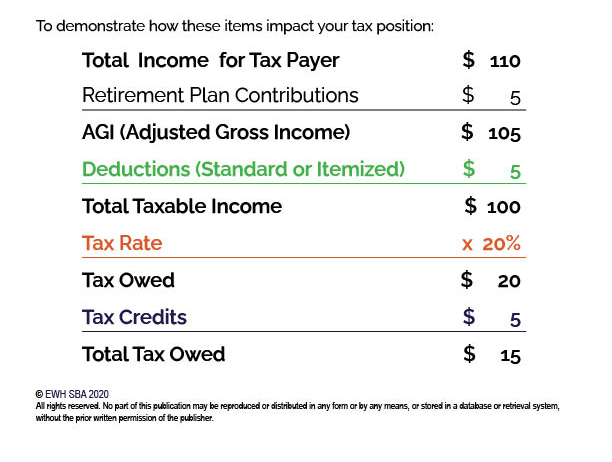

5 Factors That Determine Your Tax Position Ewh Small Business Accounting

How To Reduce Your Taxable Income Pay 0 In Taxes Millers On Fire

/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

Adjusted Gross Income Agi Definition

How To Talk To Anybody An I Will Teach You To Be Rich Product Teaching How To Be Likeable Social Skills

How Is Tax Liability Calculated Common Tax Questions Answered

How The New Health Care Law Affects Medical Expense Deductions Http Blog Taxact Com Medical Expense Deductions Adjusted Gross Income News Health Deduction

Comments

Post a Comment